In our not very stable from the point of view of economics, the question of what to invest in free cash is more urgent.

One of the tools for effective investment of money is considered to be diamonds. And for what reasons.

First of all, it is not a renewable natural resource. It is believed that with the current rates of diamond mining (of which diamonds are subsequently obtained) their deposits will dry up in about 20 years, so in the future, the situation of excess demand over the diamond supply is very likely. In addition, in a small-sized diamond can be concentrated very high cost. In addition, these precious stones are unpretentious in terms of storage and transportation, which, of course, is an advantage in case of unforeseen circumstances and natural disasters.

However, despite all the above arguments, there are nuances in diamond investments.

Ring with a diamond of classical round cut in weight of 1 carat.

The greatest investment attractiveness is represented by large diamonds weighing more than 1 carat. They show a good profitability. However, it would be wrong to think that the larger the stone, the greater the increase in value it is able to demonstrate. Brilliants of 5-10 carats are, of course, unique specimens. They can indeed show a fairly high yield, but they are more suitable for saving money than for multiplying them, since the demand for them is much more modest than for "karatniki". This is primarily due to their inaccessibility and high price per carat.

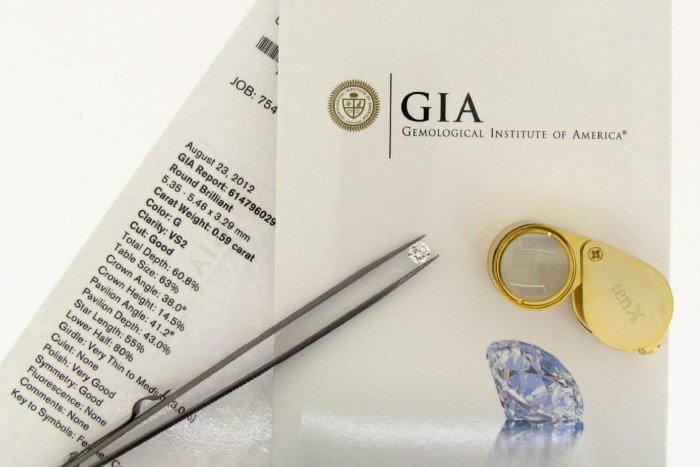

Weight is only one of the conditions for a successful diamond investment. The cost of the stone is also affected by color, purity and cut. Depending on these characteristics, the difference in price can vary within 20%. It is believed that only D, E, F and G stones are worth buying, and the purity should be at least VS2 (only with very small inclusions). With these parameters, the color of the diamond does not give into the yellowness, and the inclusions do not contain graphite. As for the form, then the palm of the championship in terms of value here belongs to the traditional round cut for a diamond. If all its parameters are strictly observed, the play of light on the faces of the gem will be maximum.

As a rule, all information about the characteristics of a diamond can be found in the certificate, which is a kind of passport of the product, confirming its quality. Acquire a precious stone, the characteristics of which are not documented, is very risky. In this case, preference should be given to diamonds certified by the world's leading laboratories (for example, GIA, HRD or EGL), which are recognized experts in the evaluation of these precious stones.

GIA Certificate. Photo: GIA

Unfortunately, prices for diamonds are also subject to fluctuations. Pricing, first of all, depends on the main market players who can reduce or, conversely, increase the supply of raw materials to maintain the balance of supply and demand.

And, finally, it is worth noting that diamonds are not suitable for short-term investments. In the long run, the yield of stones with average characteristics is in most cases quite comparable to the yield of a bank deposit. Therefore, the most significant dividends that can be counted on by investing in this precious stone are those inexpressible emotions that you experience when you see a dazzling diamond on your finger. And this, you must agree, is the best investment.